michigan unemployment income tax refund

By accessing and using this computer system you are consenting to system monitoring for law enforcement and other purposesUnauthorized use of or access to this computer system may subject you to state and federal criminal prosecution and penalties as well as civil penalties. So far the refunds are averaging more than 1600.

Where S My Refund Michigan H R Block

The federal unemployment exclusion is reported on line 8 of the federal Form 1040 Schedule 1.

. There are two options to access your account information. - Taxpayers who filed their state individual income tax returns and collected unemployment benefits in 2020 should consider filing an amended return if they havent yet received their entitled tax relief according to the Michigan Department of Treasury. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits.

Michigan taxpayers who qualify to receive a refund from the unemployment exclusion should file amended returns and claim the refund if they claimed a refund on their original return or paid any taxes due upon filing the original return. This system contains US. Unemployment compensation is generally included in adjusted gross AGI income under the IRC.

These stimulus payments are not considered as taxable but a refundable credit of your income tax return. The Michigan Department of Treasurys Taxpayer Advocate provided our team with the following update. 4 Effect of the American Rescue Plan Act on the taxation of unemployment compensation.

The refunds are only for people with a gross income under 150000 and only counts toward the first 10200 of unemployment earnings in 2020. Rather the federal adjustment will result in a lower Adjusted Gross Income for many federal taxpayers. That means the average refund for one week of unemployment from last spring and summer would be roughly 40.

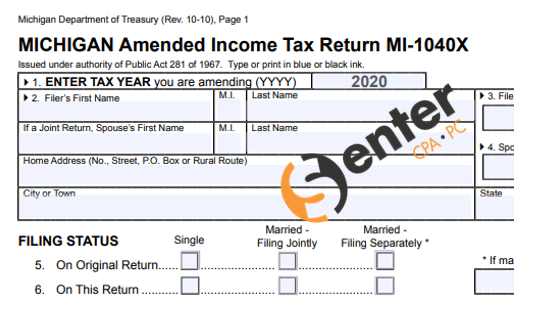

Adjusted Gross Income is found on line 10 of your MI-1040. To complete properly check Box N and on line 8 Explanation of changes please write Federal Unemployment Exclusion. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

The net taxable unemployment compensation from federal Form 1040 Schedule 1 is included in federal. Michigans state income tax is 425. June 1 2019 236 PM.

You pay tax in your home state only. Adjusted Gross Income AGI or Total Household Resources THR Note. Primary filers Social Security number.

The 10200 is the refund amount not the income exclusion level for single taxpayers. Check For The Latest Updates And Resources Throughout The Tax Season. Michigan residents who paid taxes on unemployment benefits in 2020 must file an amended tax return with the state in order to get that money back.

Ad File your unemployment tax return free. Therefore this income will not be taxed at the year end. For example a taxpayer received 10 months of equal unemployment income on benefits of 1200 beginning March 1 2020 and received a.

Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return. Additional Income and Adjustments to Income. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

Adjusted Gross Income AGITotal Household Resources THR If your AGI is a negative number enter - after the number. Ad Learn How Long It Could Take Your 2021 State Tax Refund. During the pandemic federal law was changed so.

See How Long It Could Take Your 2021 State Tax Refund. In order to view status information you will be prompted to enter. The irs identified at least 13 million people who may have.

The State of Michigan has issued a decision on the treatment of unemployment compensation for the 2020 tax year. Include schedule AMD which captures the reason why you are amending the return. Unemployment income is allocated to the state of residence at the time of receipt.

Include all forms and schedules previously filed with your original return. Michigan Income Taxes. These taxpayers should file an amended Michigan income tax return to claim that refund.

Michigan officials arent sure how many Michiganders are owed state unemployment tax refunds Leix said. The federal American Rescue Plan Act was signed into law on March 11 2021. Premium federal filing is 100 free with no upgrades for premium taxes.

Therefore unemployment compensation is also included in Michigan taxable income. Use the MI-1040 and check the amended box. If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings.

Primary filers last name. However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. If a taxpayer is a part-year Michigan resident the federal unemployment income exclusion is prorated over the same period as the unemployment income.

Total Household Resources are found on line 33 of your MI-1040CR or line 34 of your MI. The amount of income taxes withheld from unemployment revenues spiked to 557 million in the 2020 fiscal. 100 free federal filing for everyone.

Michigan has a flat income tax rate of 425. For state purposes taxable. For the federal income tax return total unemployment compensation is reported on Line 7 of federal Form 1040 Schedule 1.

Say Thanks by clicking the thumb icon in a post. Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back from a new tax break. To check the status of your Michigan state refund online visit Michigangov.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. Theres a flat 425 tax on most income in Michigan. Account Services or Guest Services.

There is no state-level deduction for the unemployment compensation relief provided by the American Rescue Plan Act of 2021. The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from. How to check your irs transcript for clues.

State Of Michigan Taxes H R Block

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

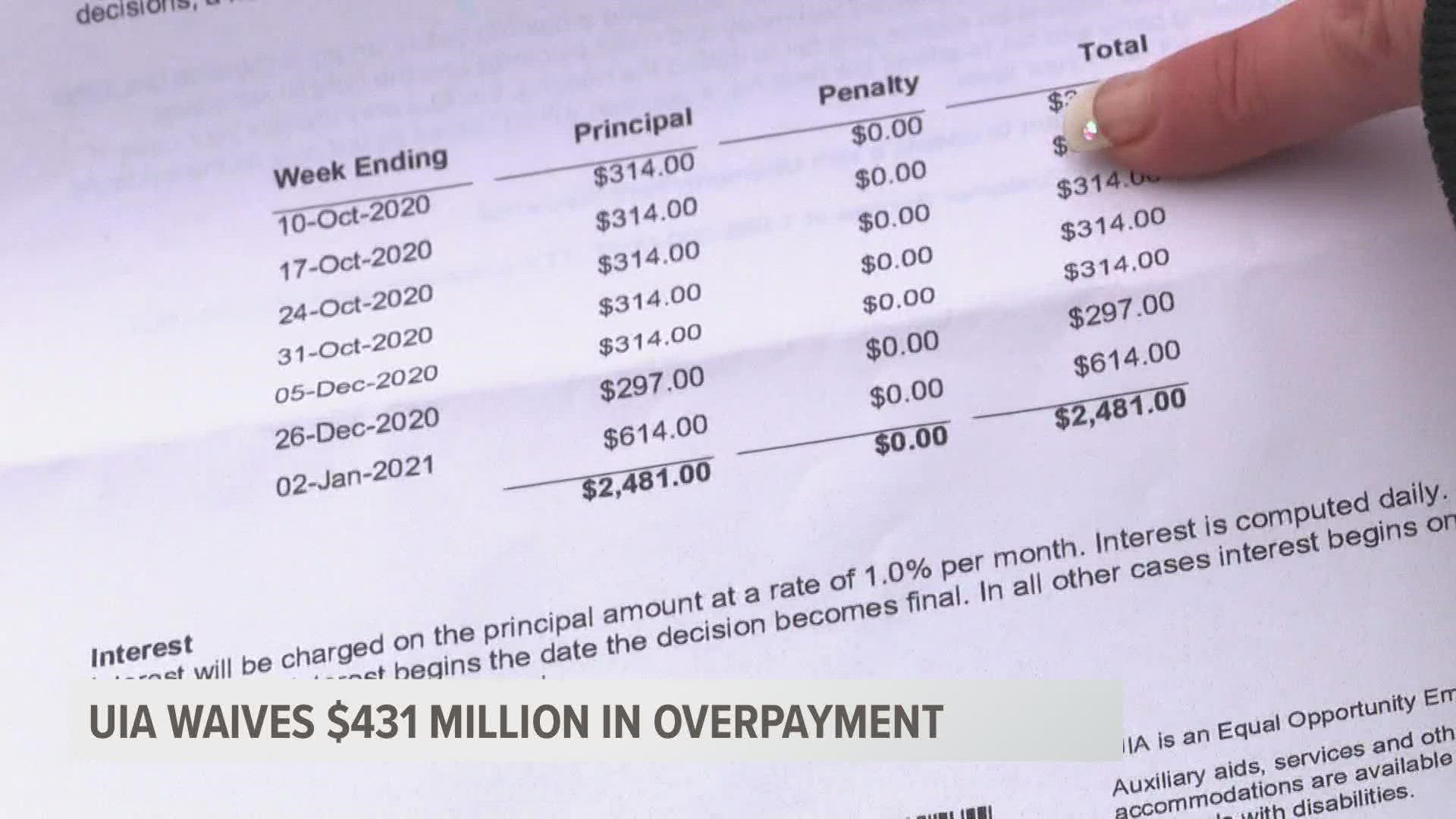

Mich Pays 431m In Unemployment Waivers To Claimants

Income Tax Season 2022 What To Know Before Filing In Michigan

Leo Work Opportunity Tax Credit

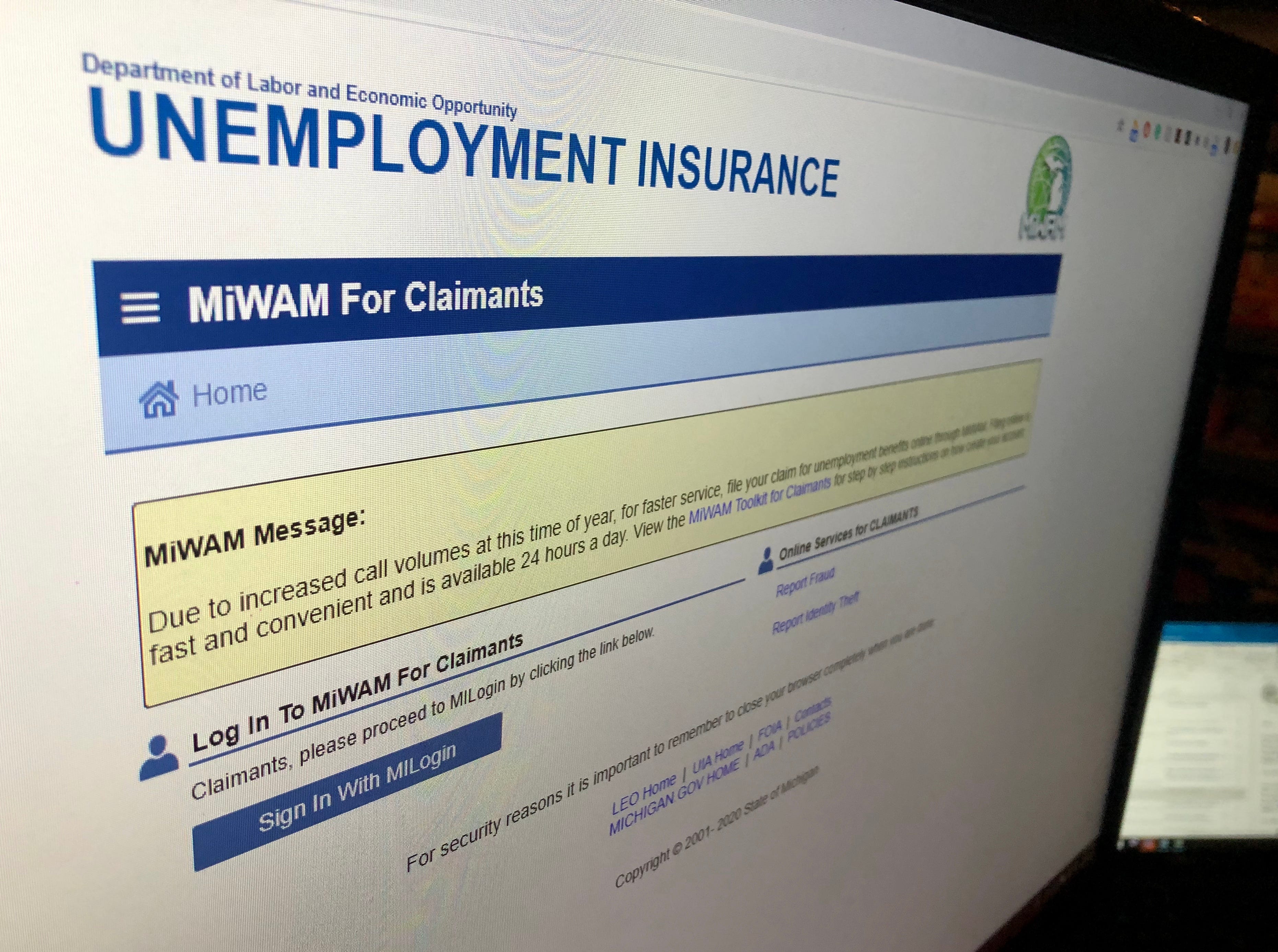

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

State Pushes Back Release Of Unemployment Aid Tax Forms

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Michiganders Are Still Facing Steep Bills From An Unemployment Agency Error Experts Worry Their Tax Returns Could Be Seized Mlive Com

Michigan Families Need Unemployment Benefits And A Functional System

Michigan Uia Waives 431 Million In Overpayments Wzzm13 Com

Uia Says 1099 G Tax Forms Will Be Send Out Towards The End Of February Weyi

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Delayed State Jobless Aid Forms Needed To File Taxes Now Available Online

Michigan S Uia Pauses Collections Against 400 000 Claimants With Overpayment Letters

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/G6G46ZZK6RCUTCV5WQ766FNQXM.jpg)